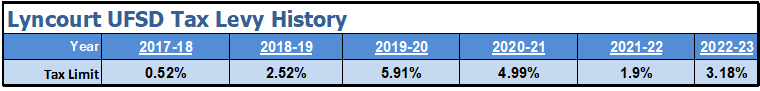

Tax Information

TAX LEVY LIMIT

Although New York State now has what is commonly called a “2 percent property tax cap,” the law does not necessarily restrict proposed

The 2 percent figure is just one part of a complex formula that school districts must use to calculate two of their tax levy numbers, the tax levy limit and the maximum allowable tax levy. These numbers, which establish more of a threshold than a cap, help a district determine its proposed tax levy.

Tax levy limits, explained

The tax levy limit is the highest allowable tax levy (before exemptions) that a school district can propose as part of its annual budget for which a simple majority of voters (50 percent + 1) would be required for authorization.

Any proposed tax levy amount above this limit would require budget approval by a super-majority (60 percent or more) of voters. The tax levy limit sets a threshold requiring districts to obtain a higher level of community support for a proposed tax levy above a certain amount.

Tax Levy Calculation

The tax levy affects more than just one year’s budget. Part of the calculation of the tax levy limit is based upon the prior year’s levy times the Consumer Price Index up to 2% (if the CPI is under 2%, the lesser number must be used, if over, no more than 2% can be used).

If the allowable tax levy is not sought, the district forfeits part of the revenue for that year and the years to come since one year’s tax levy is built on the prior year’s tax levy.